The top 10 stocks for 2025 are the stocks of companies that are scaling up a business or enjoying tailwinds in their respective sectors that will continue to grow and the stock prices will follow the same.

Which are the best Indian stocks for 2025 you can own to make a return? Let us check out the story in each of the companies one by one.

Top 10 Picks for 2025

We have categorized stocks into core and booster; know more about the same here.

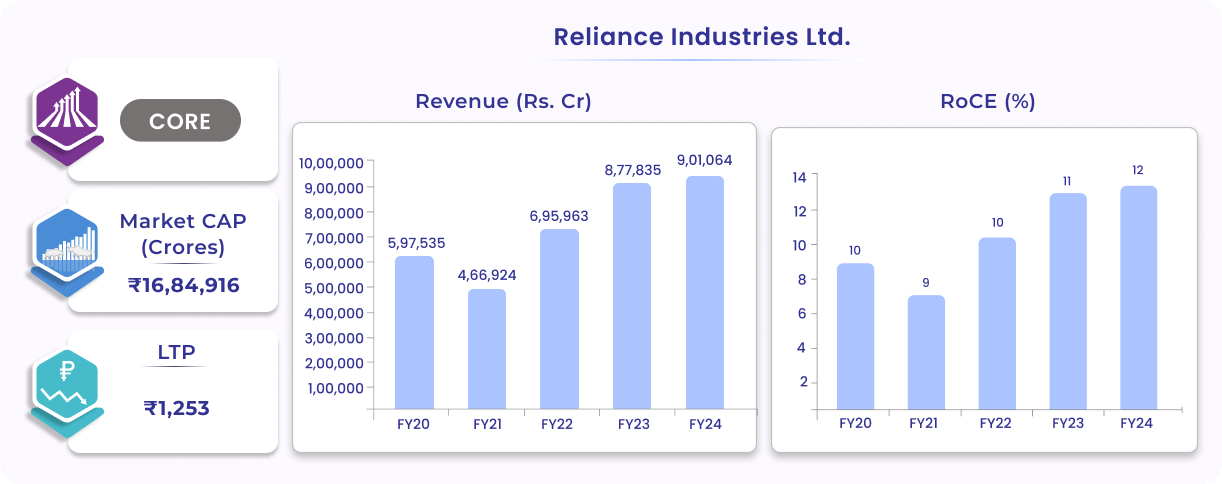

1. Reliance Industries:

Reliance Industries (RIL) is the largest private sector company in India, having leadership positions in its businesses which span across petroleum, refining and marketing, petrochemicals, hydrocarbon exploration and production, retail, and digital services businesses. It is among the top 10 petrochemical product producers in the world.

The company reported tepid performance in its overall business in H1FY25. Growth in digital services and the oil-to-gas segment was negated by weak O2C performance, with the retail segment performance being a mixed bag. However, newer growth avenues, a strong execution history, scalable businesses, a comfortable debt-to-equity ratio combined with strong free cash flow generation, and value unlocking from the demerger (Jio/retail), lead us to believe that RIL provides an opportunity.

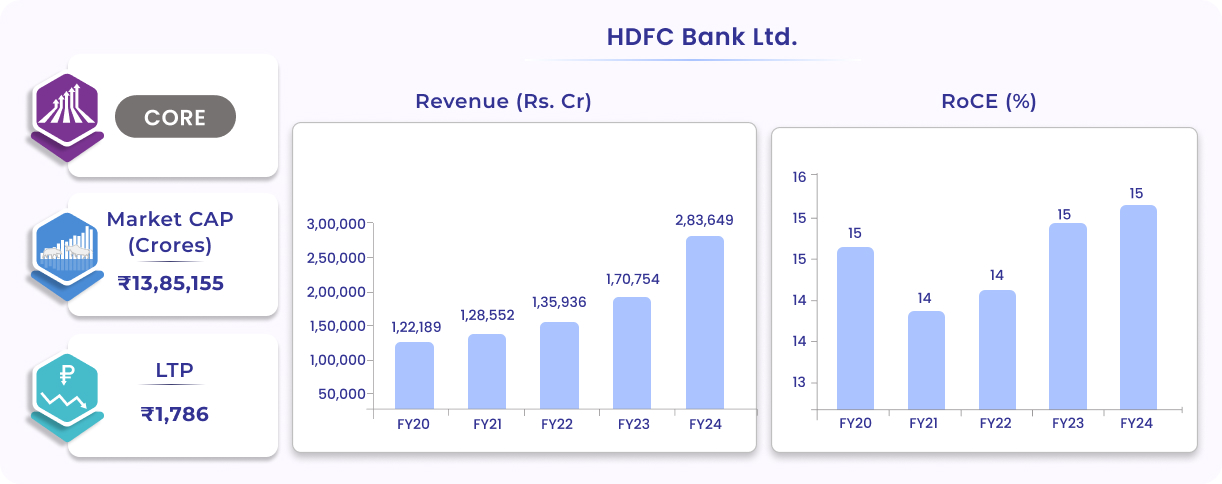

2. HDFC Bank:

HDFC Bank is the largest private sector bank in India, offering a wide range of banking services, including commercial and transactional banking in the wholesale segment, and branch banking in the retail segment. Its focus is on car finance, business banking loans, commercial vehicle finance, credit cards, and personal loans. HDFC Bank has an impeccable execution track record for year-on-year growth as it scaled up from a low base in the previous decade, with limited impact from economic slowdowns. Granular, short-term loans in highly profitable industries are the reason for its strong track record on asset quality.

HDFC Bank has exhibited more than 16% CAGR in net interest income and 18%+ growth in adjusted EPS over the last five years. Currently, its net NPA stands at 0.4%. Current valuations are much better than the historical multiples it has traded at. HDFC Bank should give decent returns in CY2025.

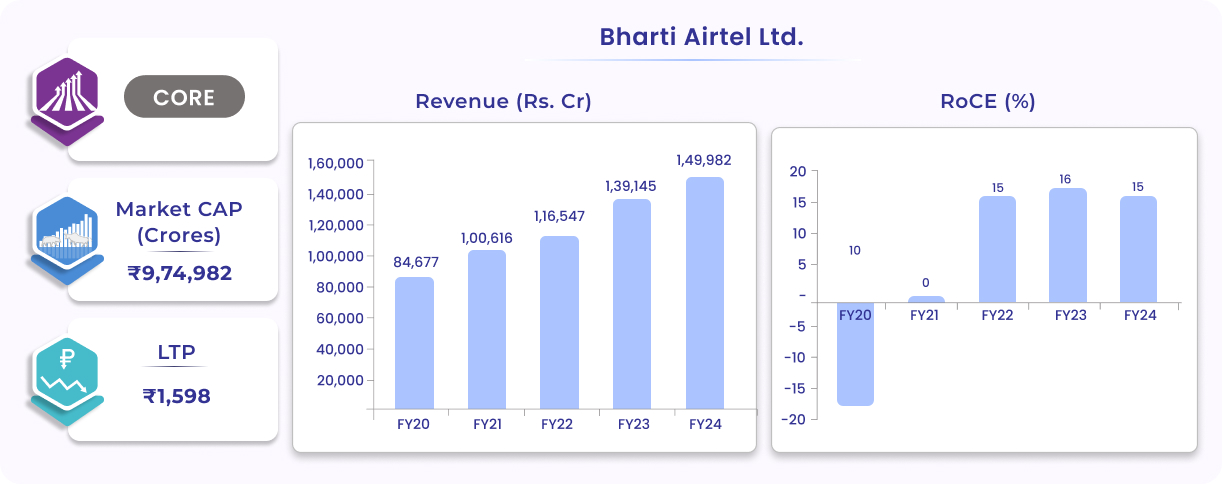

3. Bharti Airtel:

Bharti Airtel provides telecommunication services in India. It offers telecom services under wireless and fixed-line technology, Digital TV, and complete integrated telecom solutions to enterprise customers under a unified brand, ‘Airtel.’ The company also owns tower infrastructure pertaining to telecom operations through its subsidiary and joint venture entity. It has operations across Asia and Africa and ranks among the top 3 mobile service providers globally in terms of subscribers.

The company has undertaken a tariff hike with positive results as there were no signs of down-trading of customers. The reflection of this hike will be visible in revenues from H2FY25. The company has the highest ARPU (Average Revenue per User) in the country at Rs. 209, with further room for tariff hikes. The management expects capex to moderate this year, primarily driven by slower 5G spectrum expansion. The growth in earnings for Bharti Airtel will come through tariff hikes and changes in tariff architecture. This, along with improved free cash flow conversion due to the completion of major capex, positions Airtel as a strong candidate for rerating next year.

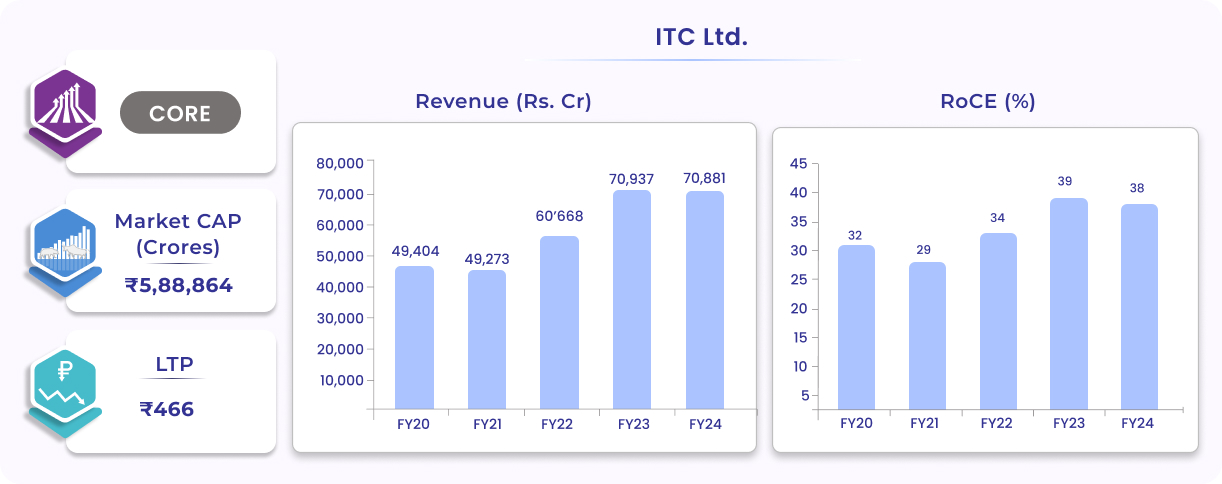

4. ITC:

ITC is a professionally managed conglomerate with interests in cigarettes, hotels, paperboards and speciality papers, packaging, agribusiness, packaged foods and confectionery, IT, apparel, personal care, stationery, matchsticks, and other FMCG products. ITC is one of India’s leading FMCG marketers. ITC Hotels, launched in 1975, is India’s premier chain of luxury hotels, which will be demerged from the main ITC Company effective 1st Jan 2025.

ITC reported strong financials in H1FY25 amid inflationary pressures, high input costs, and adverse weather conditions. Severe cost escalation in leaf tobacco, a key input for tobacco products, was partially mitigated through improved mix, strategic cost management, and calibrated pricing actions. ITC’s strong cash flows combined with its strong return ratios should give good returns in CY2025.

5. Bajaj Finance:

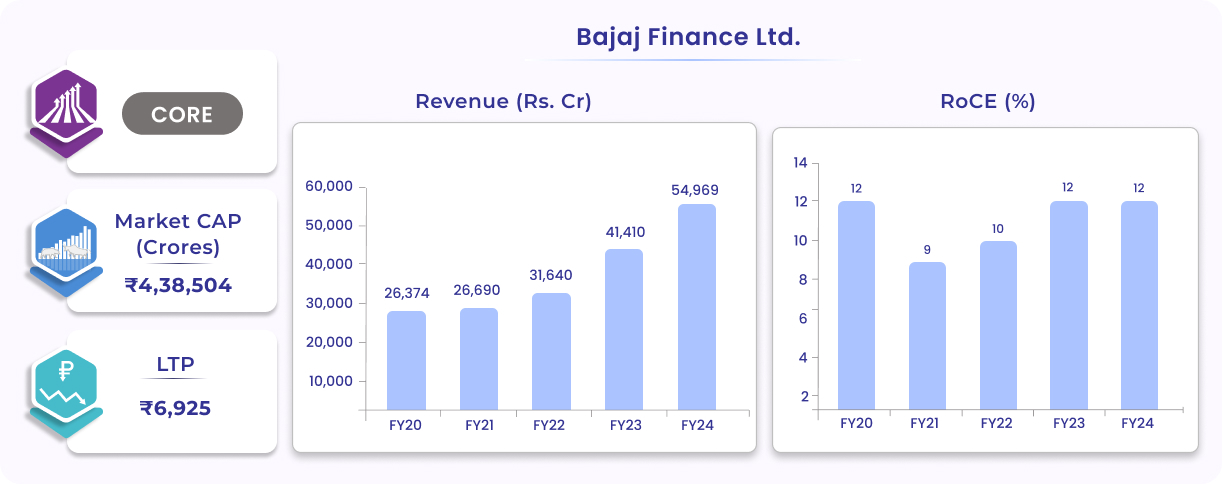

Bajaj Finance is the biggest retail-focused NBFC in India and is a subsidiary of Bajaj Finserv. The company’s lending portfolio is diversified across retail, SMEs, and commercial customers, with a significant presence in urban and rural India. It offers a variety of financial services products to its customers. Bajaj Finance is at the forefront of technology adoption among NBFCs and has continuously leveraged existing and emerging technologies to launch new products, enhance customer acquisition and servicing processes, and simplify back-office operations.

Bajaj Finance has delivered a net interest income CAGR greater than 24% and EPS growth in excess of 27% over the last five years. The company has strong asset quality, with net NPA being 0.46% in H1FY25. The company believes that its cost of funds has peaked and net interest margin (NIM) should expand. Current valuations are better than the historical multiples it has traded at, providing an attractive opportunity for next year.

6. HDFC Asset Management Company:

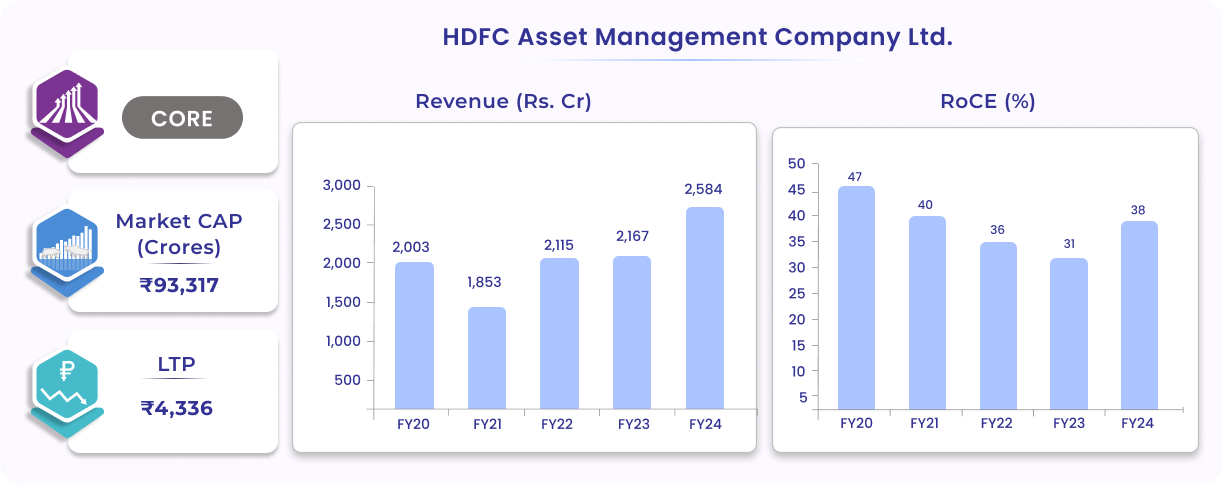

HDFC AMC is one of India’s leading mutual fund houses with a market share of ~11% (Rs. 7.7 trillion). The company has a robust distribution network of over 90,000 empanelled distributors, including banks, national distributors, and independent financial advisors, ensuring a strong pan-India presence. HDFC AMC maintains a well-diversified portfolio with an asset mix of 65%+ in equity-oriented schemes and ~20% in debt as well as 15% in other schemes, reflecting its balanced approach. Promoted by HDFC Ltd., its disciplined fund management and strong governance have reinforced its leadership position in the asset management space.

Opportunities under SEBI's new asset class framework (in the finalization stage) offer greater flexibility and a higher risk-reward profile, bridging the gap between mutual funds and PMS/AIF with lower minimum investment requirements. It enables innovative strategies, including derivatives, while remaining under the strong regulatory framework of mutual funds. With a long runway for growth, market leadership, and high margins, HDFC AMC is a stock to keep on your radar.

7. TBO Tek:

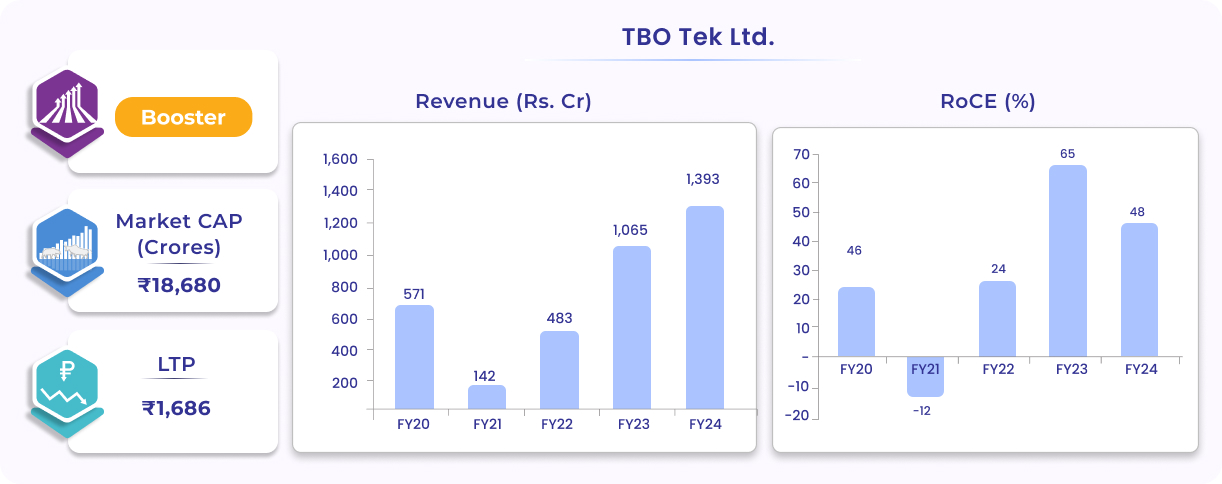

TBO (Travel Boutique Online) Tek Limited was founded in 2006 and is a leading global travel distribution platform. Its platform enables the large and fragmented base of suppliers (hotels, airlines, car rentals) to display and market their inventory to a large and fragmented global buyer base (tour operators, travel management companies, online travel agencies). It offers an integrated, multi-currency, and multi-lingual one-stop solution that assists buyers in discovering and booking travel for destinations worldwide, catering to various travel segments including leisure, corporate, and religious travel. Currently, they have about 2.46 lakh yearly transacting suppliers and 0.45 lakh buyers in more than 100 countries.

TBO Tek's new H-Next platform enhances travel agent support by handling complex queries, driving volumes. Though in its early stage, leveraging AI and big data, it features AI-driven wholesale pricing (boosting margins) and LLM-powered voice bots (improving efficiency). The integration of Jumboline (acquired in 2023) is expected to deliver full benefits in the upcoming quarters. With Rs. 1,372 crore cash on books, the company remains value-conscious while evaluating acquisition opportunities. Operating in a growing industry, TBO Tek benefits from strong network effects, creating a competitive edge.

8. Blue Dart Express:

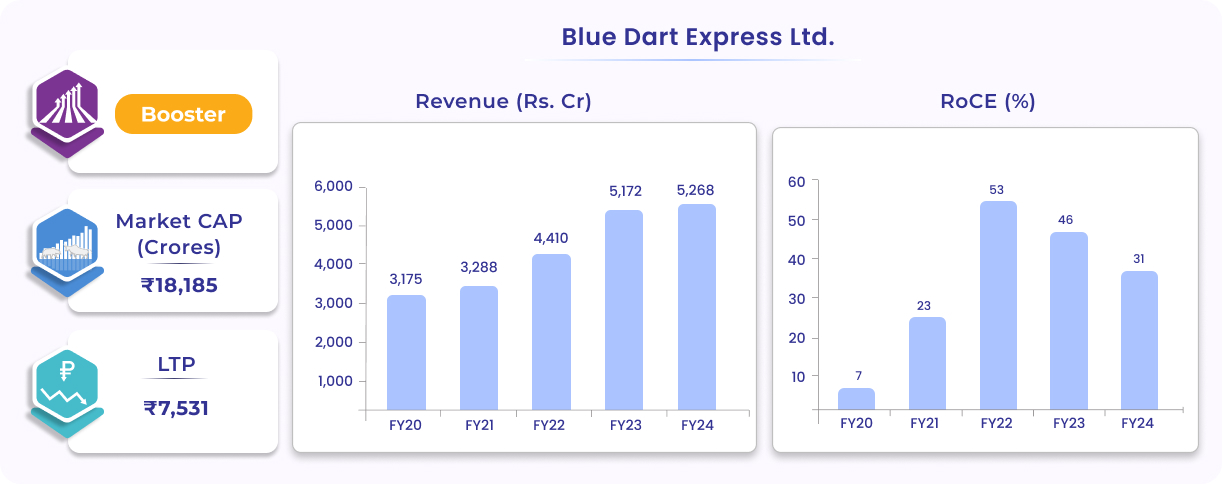

Blue Dart Express is a leading logistics and express delivery company in South Asia, specializing in time-sensitive shipments across India and international markets. As part of the DHL Group, it offers a comprehensive range of logistics solutions, including air and ground express services. Blue Dart operates a vast network of 56,400 locations, supported by advanced technology and a fleet of dedicated aircraft (8 Boeing planes).

Blue Dart has multiple levers for growth in the next few years: (a) better cargo mix—high-value cargo, (b) margin improvement, and (c) the full impact of price hikes. With an irrefutable position in express logistics, the company is well-positioned for the future.

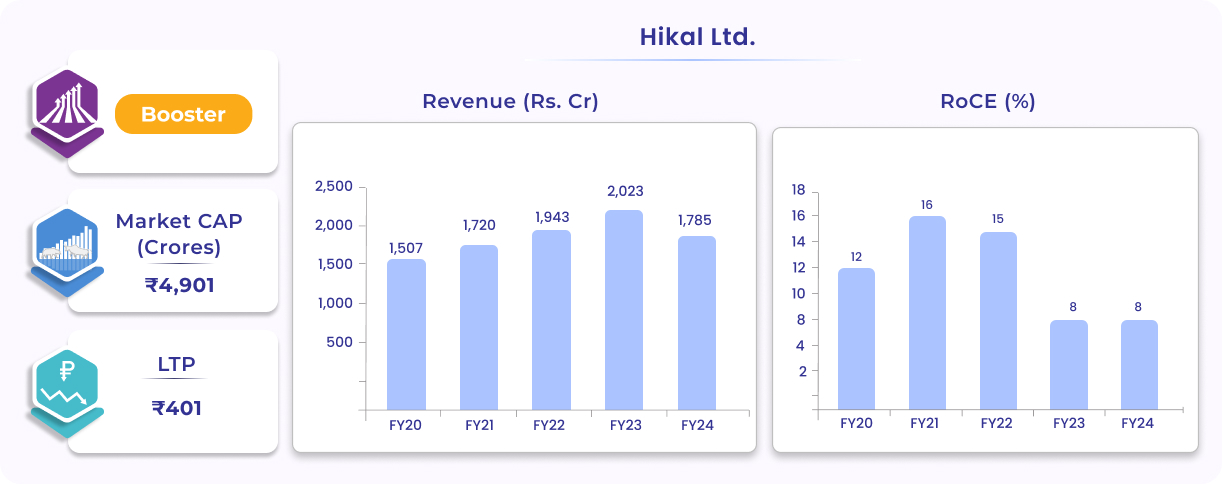

9. Hikal:

Hikal is a leading provider of pharmaceutical and crop protection solutions, serving global life sciences industries. Established in 1988, the company specializes in active ingredients, intermediates, and contract research & manufacturing services (CRAMS) for pharmaceuticals and agrochemicals. With state-of-the-art facilities and a strong focus on innovation, Hikal operates across regulated markets worldwide. It has integrated operations, robust R&D capabilities, and marquee global customers, delivering high-quality, customized solutions.

Hikal has a robust pipeline of pharma products under development and will launch 2-3 products every year. On the CDMO front, Hikal is benefiting from the China+1 strategy, with positive traction, particularly in early-stage NCE products from multiple global pharmaceutical customers. Commercial supply to innovators for a few products will start from H2FY25. The crop protection business is expected to stabilize by H1FY26 as pricing pressures ease. A multipurpose plant for animal health is now operational, and commercial production will start in 14-16 months (6 products already validated, more in the pipeline). Hikal is positioned for sustained growth in the coming years, driven by its strategic initiatives and multiple levers for expansion.

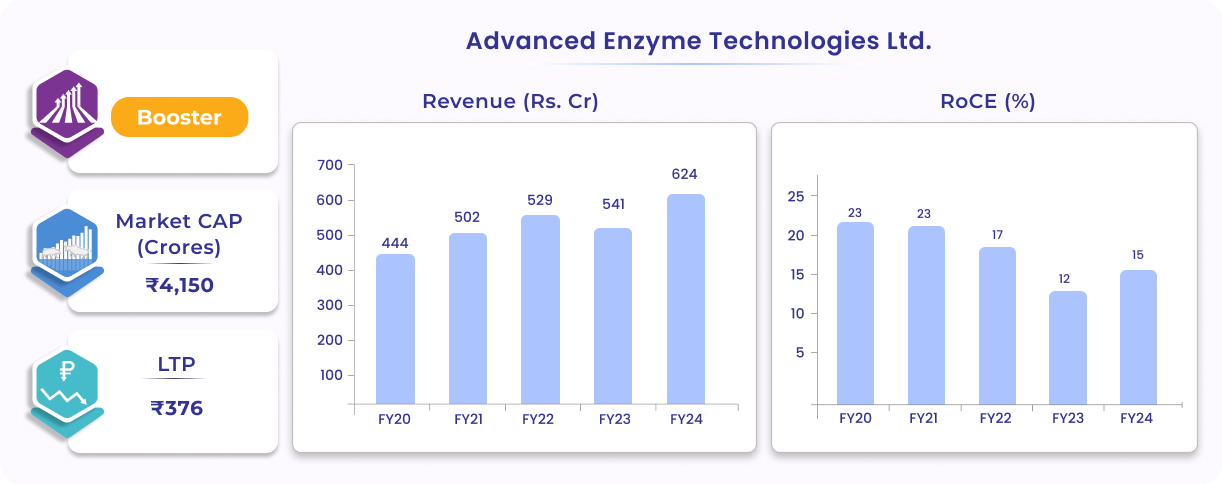

10. Advanced Enzyme Technologies:

Advanced Enzymes is a global leader in enzyme and probiotic manufacturing (India’s largest enzyme company), serving industries like human and animal nutrition, and food processing. With over 30 years of experience, it offers 400+ proprietary products developed from 65+ indigenous enzymes and probiotics. Operating in 45 countries, the company focuses on sustainable, enzyme-based solutions to replace traditional processes.

While the company has pared down its growth guidance to single digits from mid-double digits, there are growth levers in place: (a) increasing demand for inventive probiotics in the US market, (b) development of new biocatalyst molecules and new opportunities in the agriculture portfolio, and (c) non-animal or non-food bioprocessing areas. For product innovation, the company is planning to increase R&D capabilities threefold over the next few years (a new R&D centre is to be operational by the end of next year). Advanced Enzymes is a specialized business with high entry barriers and an integrated presence across the value chain. With revenue growth back on track, we expect it to do well in the coming years.

Disclosure- The above stocks are shared for further study and shouldn’t be construed as investment advice. Current prices might be high, reach out to advisors for the right price or wait for market volatility. Our clients may or may not be holding the stocks mentioned above.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: